Business

Patrice Motsepe invests up to $5 billion in bold new copper venture

Arm ramps up copper ambitions as Patrice Motsepe bets big on the green economy

South Africa’s African Rainbow Minerals (ARM) is stepping deeper into the global copper arena, and its growing alignment with Harmony Gold signals just how committed the group is to shaping its future around minerals essential to the low-carbon transition.

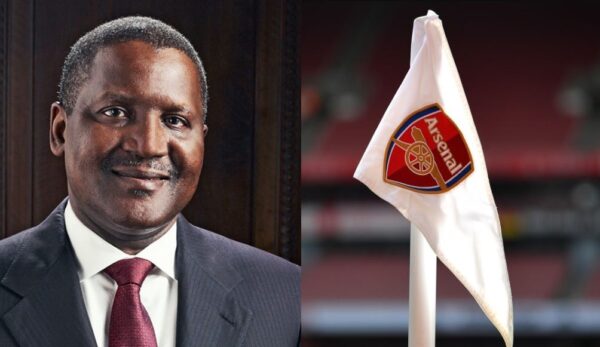

Speaking at a Bloomberg event this month, ARM chair Patrice Motsepe revealed that the company is preparing for a major copper partnership with Newmont Corporation in Papua New Guinea (PNG).

The project, which forms part of a multibillion-dollar strategy, is expected to become one of ARM’s most significant critical-minerals investments to date.

Motsepe described the copper push as “a long-term strategy”, emphasising that global decarbonisation and the rising demand for energy-transition minerals are key drivers behind the move.

Motsepe confirmed that ARM currently has about R13-billion in cash, along with an additional R7-billion in available credit.

A notable portion of this capital, he said, is being directed toward copper-rich regions such as Australia and PNG as the company shifts its investment priorities.

“There’s a huge investment that we are looking at in Papua New Guinea,” he said. “We’ve got a partnership there with Newmont that might require as much as four or five billion dollars to be invested down the line.”

Harmony Gold, in which Motsepe holds a 10.9% stake, is charting a similar course. The company owns half of the world-class Wafi-Golpu copper-gold project in PNG, also in partnership with Newmont, and sees copper as central to its long-term evolution.

Motsepe has made it clear that the capital ARM is building up will ultimately support Harmony’s copper ambitions as well, further cementing the mineral as a core part of both companies’ strategies.

Copper’s appeal lies in its undeniable relevance to the energy transition.

It is essential in electric vehicles, renewable-energy systems, water infrastructure, technology manufacturing and grid expansion, making it one of the most important minerals in the push toward decarbonisation.

Although South Africa’s copper production remains relatively modest, the sector has shown momentum, recording a 6.7% year-on-year rise in July, while the value of copper sales increased by nearly 20% over the same period. The mineral supports roughly 8 000 jobs across local value chains.

South Africa’s Just Energy Transition (JET) framework has repeatedly stressed that mining remains crucial to the economy, but must be repositioned to support new industrial opportunities.

Critical minerals such as copper, manganese, nickel and PGMs are seen as the foundation for green manufacturing, battery development, grid modernisation and related value chains.

By expanding abroad while keeping strong domestic operations, ARM and Harmony are helping ensure that South African mining remains competitive in a world rapidly reorganising around energy-transition materials.

Globally, demand for copper is expected to double by 2040, according to the International Energy Agency, driven primarily by renewable-energy installations, electric vehicles and the massive expansion of power grids.

In Africa, the copper market is projected to reach three million tonnes by 2035.

Yet analysts at S&P Global Market Intelligence warn the world could face a deficit of more than six million tonnes in the early 2030s unless major new mines begin production soon.

Against this backdrop, ARM and Harmony’s push into international copper markets may prove decisive.

Their investments ensure that South African miners remain part of the global shift toward cleaner energy, and highlight that the country cannot meet its own JET goals without reliable access to copper.